AKF Registration Last Date

AKF Registration Last Date: The Government of Punjab, under the leadership of Chief Minister Maryam Nawaz Sharif, has introduced a powerful financial initiative called the Asaan Karobar Finance Scheme. This scheme provides interest-free loans to individuals who wish to start a new business or expand an existing one. Through this support, the government aims to uplift entrepreneurs and small-to-medium businesses across Punjab.

The scheme is designed to eliminate financial barriers and offer accessible, transparent, and inclusive financing options. By offering loans ranging from 1 million to 30 million, the AKF scheme ensures that both small and medium-scale businesses can benefit according to their needs and potential. If you are looking to grow your business in 2025, this guide will walk you through everything you need to know about eligibility, the application process, benefits, and loan disbursement.

You Can Also Read: CM Punjab Ration Card Program Registration Process officially launched, offering 3000 Monthly Aid

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is a landmark program initiated to promote entrepreneurship in Punjab. It specifically targets young professionals, small business owners, and aspiring entrepreneurs who are often excluded from traditional banking loans due to a lack of collateral or high interest rates. With this scheme, the Punjab government ensures that businesses have access to zero-interest loans and adequate support to flourish.

The scheme not only promotes business activity but also aligns with Punjab’s broader economic goals, including poverty alleviation, job creation, and economic empowerment. It supports individuals from all walks of life, especially those from underrepresented communities, by giving them an equal chance to start or grow their business.

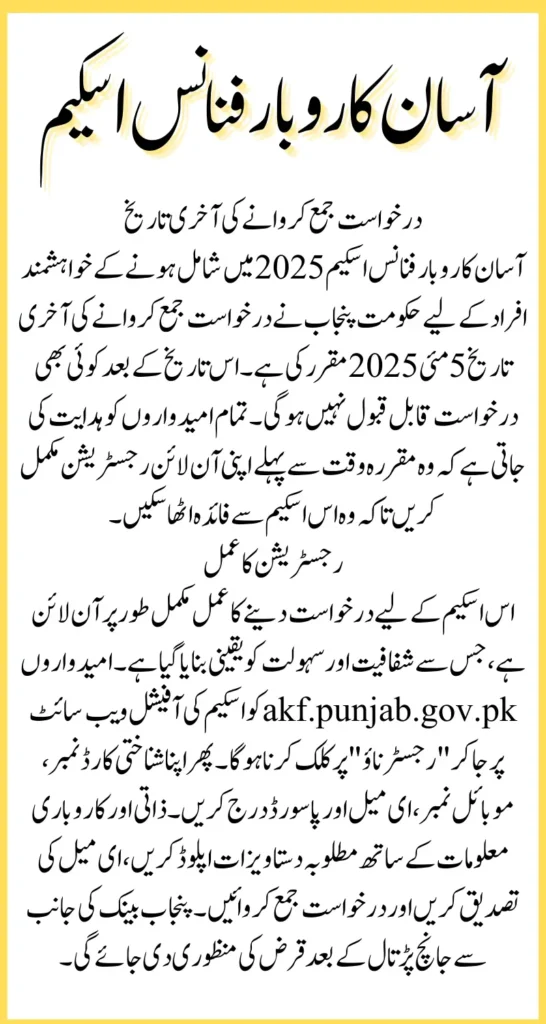

AKF Registration Last Date Has Been Announced

The final date to submit your application for the Asaan Karobar Finance Scheme is 5 May 2025. Applicants must complete the online registration process before the deadline to be considered eligible. No applications will be accepted after this date under any circumstances.

Objectives of the AKF Scheme

The AKF Punjab Scheme has been designed with several strategic objectives in mind. One of the main goals is to boost economic activity by making capital accessible to entrepreneurs who struggle to get funding through traditional banks. The scheme promotes self-reliance, encourages innovation, and creates employment opportunities across Punjab.

In addition to economic uplift, the scheme is also focused on inclusive growth. It prioritizes women, persons with disabilities, and transgender individuals to ensure that these marginalized groups receive equal access to financial resources. By doing so, the Punjab government ensures social equity along with economic development.

You Can Also Read: CM Punjab Laptop Distribution 2025 Begins – Learn How to Get Yours Easily

Eligibility Criteria For Successful Registration

To ensure the right candidates are selected, the Punjab government has defined specific eligibility criteria. Only those who meet the following conditions are allowed to apply:

- Must be a resident of Punjab.

- Age should be between 25 to 55 years.

- Must be a registered tax filer with the Federal Board of Revenue.

- Business must be located in Punjab

- Have not taken a loan from any bank before

These requirements ensure that the scheme targets genuine entrepreneurs who are either just starting or are in the early stages of business development. The focus remains on financial transparency, responsible borrowing, and targeted support.

Required Documents For Application

Applicants must prepare and upload a few important documents during the online registration process. Here is a checklist:

- Computerized National Identity Card (CNIC)

- National Tax Number NTN certificate

- Business ownership proof or lease agreement

- Mobile number registered in the applicant’s name

- Valid and active email address

- Recent passport-sized photograph

Having these documents ready before starting the registration process will help applicants complete their application without delays or rejections.

You Can Also Read: CM Punjab Wheat Support Program 2025 Know Requirements And Online Registration Process

Loan Tiers and Financial Structure

The AKF scheme is divided into two distinct loan tiers based on the business’s financial size and capital requirement. Below is a detailed table showing the two tiers

Tier 1:

- Loan Range: 1 million – 5 million

- Collateral: Personal Guarantee

- Processing Fee: PKR 5,000

- Tenure: Up to 5 years

- Interest Rate: 0% Interest-Free

- Grace Period: 6 months (for startups)

Ties 2

- Loan Range: 6 million – 30 million

- Collateral: Secured Assets

- Processing Fee: 10,000

- Tenure: Up to 5 years

- Interest Rate: 0%, Interest-Free

- Grace Period: 3 months for existing businesses

These two options provide flexibility to applicants based on their current business standing and investment capacity. Small businesses can start with Tier 1, while medium-scale enterprises can apply for Tier 2 with higher capital needs.

Benefits of the Asaan Karobar Finance Scheme

This scheme brings a wide array of benefits that are designed to make financing accessible, inclusive, and growth-oriented. Unlike commercial bank loans, the AKF scheme eliminates the burden of interest payments and lowers entry barriers for small entrepreneurs.

Key benefits include:

- Zero Interest: Entirely interest-free, reducing repayment pressure.

- Inclusivity: 10% equity contribution waiver for women and transgender individuals

- Up to 5-year repayment period with a grace period.

- Environmental Support: Incentives for businesses using green or RECP technologies.

- Fully Online Process, No need for in-person visits; everything is done digitally.

These advantages are tailored to ensure businesses receive both financial and administrative ease during the startup or expansion phases.

You Can Also Read: CM Punjab Free 10000 E-Bikes Scheme 2025

Step-by-Step Online Registration Process

Applying for the AKF Punjab loan is a simple online procedure. Below is a step-by-step guide:

- Visit the Official Website https://akf.punjab.gov.pk

- Click on the Register Now button

- Enter your CNIC, email, phone number, and password.

- Fill up the registration form

- Provide personal and business details as Name, age, address

- Also, enter your NTN number, business location, sector, type

- Verify Your Email and check your email inbox

- Click the verification link

- Log In and Submit Application

- Sign in using CNIC and password

- Complete application with business specifics

- Upload required documents

- Wait for Bank Verification and Approval

- The Bank of Punjab will assess your application

- Once approved, loan amount will be disbursed directly

Following these steps ensures that your application is submitted correctly and considered promptly for loan approval.

You Can Also Read: Punjab Government Launched The Bullet Train Know Selected Tracks And Schedule

Key Details of AKF Punjab Scheme

Below is a quick summary of the most important information related to the Asaan Karobar Finance Scheme:

| Feature | Details |

|---|---|

| Scheme Name | Asaan Karobar Finance Scheme |

| Launched By | Government of Punjab CM Maryam Nawaz |

| Loan Amount | 1 million to 30 million |

| Interest Rate | 0% (Interest-Free) |

| Tenure | Up to 5 Years |

| Grace Period | 3 to 6 Months (based on business type) |

| Eligible Applicants | Small and Medium Enterprises in Punjab |

| AKF Registration Last Date | 5 May 2025 |

| Application Mode | Online Only |

| Official Website | https://akf.punjab.gov.pk |

Additional Opportunity: Maryam Nawaz Loan Scheme

Apart from the AKF scheme, CM Punjab Maryam Nawaz has also introduced another financial support system called the Maryam Nawaz Loan Scheme. This also provides interest-free loans to individuals at a smaller scale.

- Small Loan Range: 100,000 – 1 million

- Medium Loan Range: 1 million – 30 million

Both schemes run concurrently and applicants can apply based on their business category:

- Small business registration: https://akc.punjab.gov.pk

- Medium business registration: https://akf.punjab.gov.pk

These initiatives collectively aim to stimulate Punjab’s economy through entrepreneurship.

Final Words Of AKF Registration Last Date

The Asaan Karobar Finance Scheme is more than just a loan program. It is an opportunity for transformation for individuals, families, and entire communities across Punjab. By providing interest-free loans, eliminating complex paperwork, and targeting marginalized groups, this scheme opens the door to a brighter, self-sufficient future for entrepreneurs.

If you have a business idea or want to expand your current setup, this is the time to act. Make sure to complete your registration before the last date, 5 May 2025.

You Can Also Read: BISP Payment Method For May 2025 For Eligible Latest Update

FAQS Of AKF Registration Last Date

Who can apply for the AKF loan?

Any tax-filing resident of Punjab aged between 25–55 with a business in Punjab.

What is the interest rate?

0%, the loans are completely interest-free.

Is collateral required?

Tier 1 loans need only a personal guarantee. Tier 2 loans require secured assets.

Can women and disabled persons apply?

Yes, and they receive a 10% equity waiver benefit.

What is the AKF Registration Last Date?

The deadline is 5 May 2025.