Asaan Karobar Card Eligibility Criteria

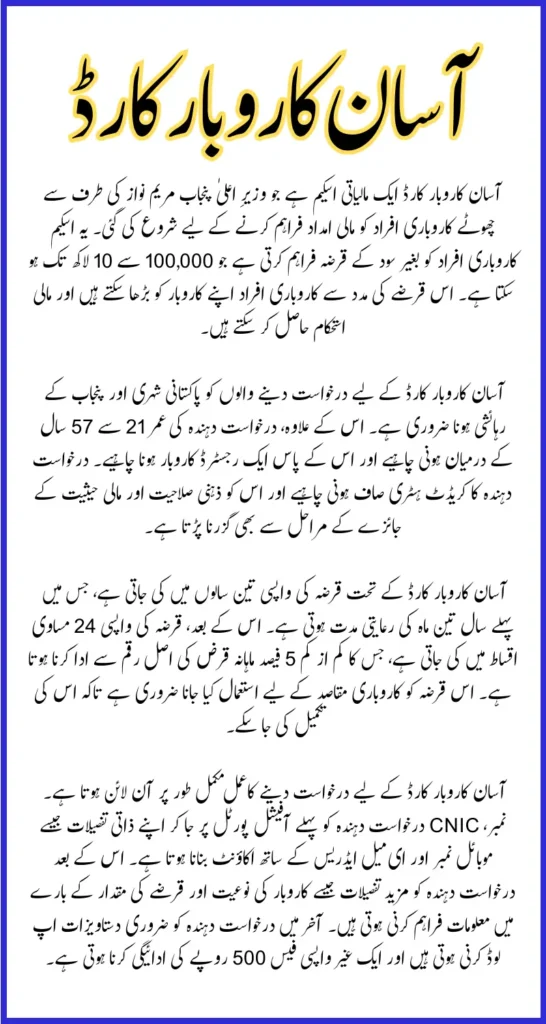

Asaan Karobar Card Eligibility Criteria The Asaan Karobar Card, launched by the Chief Minister of Punjab, Maryam Nawaz, is an initiative designed to empower small entrepreneurs and youth in the province of Punjab, Pakistan. This scheme provides interest-free loans ranging from 100,000 to 1 million to help individuals establish or grow their businesses. The loan is structured through a digital SME card, which allows entrepreneurs to make business-related transactions through mobile apps, POS systems, and other digital platforms, ensuring transparency and ease of use. The primary objective of this scheme is to promote economic independence among small business owners, helping them achieve financial stability and success in an increasingly digital and competitive market.

The Asaan Karobar Card is not just a loan program but also a comprehensive support system that encourages responsible financial management. The loan is designed to be flexible and offers a repayment plan that stretches over three years. With the first year being a grace period and repayments starting only after three months, it provides borrowers ample time to establish and stabilize their businesses. This initiative also ensures that entrepreneurs have access to funds when they need them most, offering up to 25% of the total loan limit for cash withdrawals for miscellaneous business expenses. The card’s design ensures that the funds are used strictly for business purposes, preventing misuse for non-business-related expenses.

You Can Also Read: CM Punjab Bewa Sahara Card Application Process Know What Are The Necessary Documents

Key Features of the Asaan Karobar Card

Asaan Karobar Card Eligibility Criteria The Asaan Karobar Card comes with several notable features that make it an attractive financial tool for small entrepreneurs. The loan amount available under this scheme ranges from 100,000 to 1 million, offering a substantial amount of capital for small business owners to start or grow their businesses. The repayment period extends for three years, with 24 equal monthly installments after the first year. A significant benefit is the grace period of three months from the card issuance before any repayments are due.

Funds disbursed under the Asaan Karobar Card can be used for various business-related purposes, such as making payments to vendors and suppliers, settling utility bills, and covering government taxes and fees. The funds can also be used for cash withdrawals, but only up to 25% of the total loan limit. This flexibility helps small businesses manage their expenses efficiently, without having to rely on personal loans or resources. Furthermore, the loan is entirely interest-free, with no hidden charges, which sets it apart from traditional loan schemes offered by banks and financial institutions.

You Can Also Read: Punjab CM Laptop Scheme 2025 Guide To Check Result You Are Eligible Or Not Latest Update

Asaan Karobar Card Eligibility Criteria

To be eligible for the Asaan Karobar Card, applicants must meet a set of specific criteria. The scheme is designed to support small entrepreneurs within the province of Punjab, so the first requirement is that the applicant must be a resident of Punjab. Additionally, the applicant must be a Pakistani national and aged between 21 and 57 years. This age range is chosen to include young entrepreneurs who are looking to start their businesses and individuals who may be well-established in their careers but need financial support to expand. The applicant’s business must be located in Punjab, and they must have a valid CNIC and a registered mobile number.

Applicants must also meet certain financial and business criteria. This includes having a clean credit history with no overdue loans. Furthermore, applicants need to pass a psychometric and creditworthiness assessment, which will help determine whether they are financially capable of repaying the loan. It is important to note that only one application per individual or business is allowed, which means that each entrepreneur can only avail of the loan once. Registration with PRA (Punjab Revenue Authority) or FBR is mandatory within six months after receiving the card, ensuring that the business is compliant with tax regulations.

You Can Also Read: How To Verify Payment 5000 Of 9999 Ramzan Package By Shahbaz Sharif Know In Details

How to Apply for the Asaan Karobar Card

Asaan Karobar Card Eligibility Criteria Applying for the Asaan Karobar Card is a simple process that can be completed entirely online. To begin, applicants must visit the official portal of the Asaan Karobar Card at https://akc.punjab.gov.pk. Upon arriving at the site, users are required to create an account by registering their details, including their CNIC number, mobile number, and email address. After completing the registration process, the applicant will receive a confirmation email with login credentials to access the application portal.

Once logged in, applicants need to fill in more detailed information, including personal, business, and loan-related details. This may include the nature of the business, the amount of the loan required, and a brief description of how the loan will be utilized. After completing the application form, applicants are required to upload the necessary documents, such as copies of their CNIC, business registration documents, and any other paperwork required by the scheme. The final step is to pay a non-refundable processing fee of PKR 500, which is required for the application to be processed. Once submitted, the application is reviewed by authorized agencies, and the approval process generally takes between 4 to 6 weeks.

You Can Also Read: CM Punjab Maryam Nawaz Sharif Laptop Scheme 2025 Registration Has Been Closed And Result Announced

Loan Usage and Repayment Terms

Asaan Karobar Card Eligibility Criteria The loan under the Asaan Karobar Card is intended solely for business-related expenses, ensuring that the funds are used to support the growth of the business. The first 50% of the loan amount is made available for use within the first six months after the loan is issued. During this period, the borrower can use the loan to make payments to vendors, suppliers, and cover other essential business expenses. The second 50% of the loan is only released after the borrower has used the first portion responsibly, made regular repayments, and registered their business with the PRA/FBR.

The repayment of the loan is structured over three years, with a three-month grace period after the issuance of the card. During this time, no repayments are due, allowing entrepreneurs to stabilize their businesses. After the grace period, borrowers are required to start repaying the loan in equal monthly installments, with a minimum repayment of 5% of the outstanding loan balance (principal portion only). The loan must be repaid in full within two years after the first year of repayment. Any non-business-related usage of the loan funds will be blocked to ensure the funds remain dedicated to business growth.

You Can Also Read: CM Punjab Bewa Sahara Card Registration Process For 10000 Latest Update 2025

Charges and Fees Associated with the Asaan Karobar Card

Asaan Karobar Card Eligibility Criteria While the Asaan Karobar Card offers a great deal of flexibility and convenience, applicants need to be aware of the associated charges. One of the primary fees is the annual card fee, which amounts to 25,000, plus the federal excise duty. This fee will be deducted from the approved loan limit. Other charges include fees for card issuance, delivery, and life assurance, which are all covered by the scheme. Additionally, if the borrower fails to make timely repayments, late payment charges will be imposed according to the bank’s policies.

It is crucial that borrowers stay on top of their repayment schedules to avoid penalties and additional charges. The loan repayment is designed to be flexible and affordable, with a minimum monthly installment of just 5% of the outstanding loan balance. However, missing payments can result in fees, and the loan may become more expensive in the long term. Therefore, borrowers are advised to manage their finances carefully and ensure that they are able to make their repayments consistently to avoid financial strain.

You Can Also Read: CM Punjab Ramzan Program 2025 Complete Registration Before Deadline

Security And Verification Process

In addition to the application process, there are certain security measures in place to ensure that the loan is used responsibly and the borrower’s interests are protected. One of the key security measures is the personal guarantee that the borrower must digitally sign. This guarantee holds the borrower accountable for the repayment of the loan, ensuring that there is a commitment to the terms of the agreement. Additionally, the loan includes life assurance, which is designed to protect the borrower in case of unexpected events.

As part of the verification process, the Urban Unit conducts a physical verification of the business premises within six months of loan approval. This ensures that the business exists and is being run according to the terms of the loan agreement. After the initial verification, the Urban Unit will conduct annual checks to ensure the ongoing compliance of the business with the loan’s terms and conditions. This verification process helps maintain the integrity of the scheme and ensures that the funds are being used for their intended purpose.

You Can Also Read: CM Punjab Bewa Sahara Card Application Process Know Necessary Documents

Conclusion Of Asaan Karobar Card Eligibility Criteria

Asaan Karobar Card Eligibility Criteria The Asaan Karobar Card is a remarkable initiative by the Punjab government that aims to provide financial support to small entrepreneurs in the province. With its easy online registration process, flexible loan terms, and transparent repayment structure, the scheme offers a valuable opportunity for individuals to start or grow their businesses. The interest-free nature of the loan, combined with its extensive use cases, makes it a favorable option for small business owners who need capital to scale their operations. By offering financial support and encouraging responsible financial management, the Asaan Karobar Card is paving the way for a new generation of entrepreneurs in Punjab.

Small businesses are the backbone of any economy, and the Asaan Karobar Card is helping to nurture and grow this critical sector. With the support of the provincial government and the flexible terms of the scheme, entrepreneurs can access the funds they need to succeed without the burden of high interest rates or complicated financial requirements. The digital nature of the card ensures ease of use and transparency, making it a modern solution to the challenges faced by small business owners. If you are an entrepreneur in Punjab looking to expand or start your business, the Asaan Karobar Card could be the key to unlocking your business’s full potential.

You Can Also Read: CM Punjab Laptop Scheme 2025 Registration Has Been Closed And Result Announced

FAQS Of Asaan Karobar Card Eligibility Criteria

What is the Asaan Karobar Card, and who launched it?

The Asaan Karobar Card is a financial initiative launched by Punjab’s Chief Minister Maryam Nawaz to empower small entrepreneurs in the province by offering interest-free loans.

What is the loan amount range offered by the Asaan Karobar Card?

The Asaan Karobar Card provides loans ranging from 100,000 to 1 million, helping small businesses grow and become financially stable.

What are the eligibility criteria for applying for the Asaan Karobar Card?

Applicants must be Pakistani nationals, aged 21-57, and residents of Punjab, with a clean credit history and a registered business.

How can one apply for the Asaan Karobar Card?

Applicants can apply online by visiting the official portal, registering, submitting required documents, and paying a non-refundable processing fee of 500.

What are the repayment terms for the loan under the Asaan Karobar Card?

The loan must be repaid over three years, with a grace period of three months, followed by equal monthly installments starting at 5% of the outstanding loan balance.