CM Punjab Loan Scheme AKF Registration

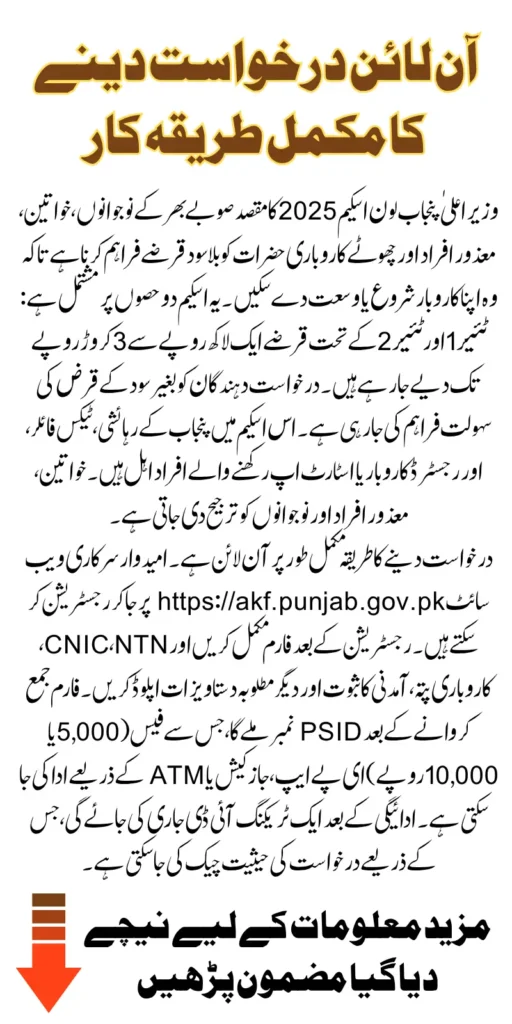

CM Punjab Loan Scheme AKF Registration: The Government of Punjab has officially reopened the registration portal for the CM Punjab Loan Scheme, offering a golden opportunity to those eligible applicants who missed the earlier phase of the initiative. The move aims to ensure no deserving entrepreneur or small business owner is left behind in this economic empowerment mission. If you were previously unable to apply due to incomplete documents or missed deadlines, this is your second chance to benefit from this interest-free loan program.

This article provides a complete walkthrough of the reopened scheme, including eligibility criteria, loan tiers, document requirements, online registration steps, and additional guidance to help you successfully submit your application.

You Can Also Read: CM E-Taxi Scheme 2025 Online Registration Know Step-by-Step Full Guide To Apply

Why Has the CM Punjab Loan Scheme Reopened?

Many aspiring applicants, especially from rural areas or small towns—faced challenges during the earlier phase such as lack of access to the internet, technical issues, or missing documentation. Recognizing this, the Punjab government, under the leadership of Chief Minister Maryam Nawaz, has reopened registration to ensure wider and fairer access.

This extension focuses on enabling financial inclusion and reaching out to the left-out SMEs, startups, women entrepreneurs, and young professionals who are ready to contribute to Punjab’s economy but lacked the means to apply in the first round.

You Can Also Read: Complete Guide To Fix 8171 BISP Payment Issues 2025 And Receive Your Rs 13500 Without Delays

What is the CM Punjab Loan Scheme?

The CM Punjab Loan Scheme is an interest-free financial initiative aimed at uplifting Small and Medium Enterprises across Punjab. The scheme is divided into two loan tiers

- Tier 1 (T1): PKR 1 million – 5 million (Personal Guarantee)

- Tier 2 (T2): PKR 6 million – 30 million (Secured Loans)

It empowers individuals to start new businesses, expand existing ones, or upgrade infrastructure in key sectors like logistics, climate-friendly technologies, services, and manufacturing.

You Can Also Read: Complete Guide To Fix 8171 BISP Payment Issues 2025 And Receive Your Rs 13500 Without Delays

Who Can Apply? Full Eligibility Criteria

To ensure that only deserving candidates benefit, the scheme outlines strict but inclusive eligibility standards. Applicants must fulfill the following:

- Age: Between 25 and 55 years

- Resident of Punjab with a valid CNIC

- Tax Filer registered with FBR

- Must own or lease a registered business location

- Clean credit history

- Annual business sales of up to PKR 800 million

- Business or proposed business must be located in Punjab

Special Preference is given to:

- Women entrepreneurs

- Differently-abled individuals

- Startups in green energy and digital tech sectors

You Can Also Read: 8171 CNIC Online Check 2025 to Verify BISP Eligibility and Payment Status Instantly

Loan Details Of CM Loan Scheme 2025

Here’s a simplified view of the loan tiers and conditions:

| Loan Tier | Amount | Security | Duration | Interest Rate | Processing Fee |

|---|---|---|---|---|---|

| Tier 1 (T1) | 1M – 5M PKR | Personal Guarantee | Up to 5 Years | 0% | PKR 5,000 |

| Tier 2 (T2) | 6M – 30M PKR | Secured (Property etc.) | Up to 5 Years | 0% | PKR 10,000 |

Additional Financial Terms:

- Grace Period: 6 months for startups, 3 months for existing businesses

- Equity Contribution:

- 0% for Tier 1 (except leased vehicles)

- 25% for leased commercial vehicles

- 20% for T2 loans (except where exceptions apply)

- Only 10% equity required for women, differently-abled, and transgender individuals

- Late Fees: PKR 1 per 1000/day on overdue amounts

- No handling fee for new businesses

You Can Also Read: 8171 Web Portal Latest Update 2025 – Check BISP Eligibility, Payment, And Registration Status Online

What Kind of Businesses Are Eligible?

Whether you’re running a grocery store, IT startup, logistics service, e-commerce platform, small-scale factory, or an energy-efficient enterprise, this scheme caters to a wide range of business models.

Examples include:

- Renewable Energy Startups

- Electric Vehicle Charging Stations

- Agro-based Processing Units

- Cold Storage and Logistics

- Online Retail & Delivery Services

- Small Manufacturing Units

- Women-led Beauty & Salon Businesses

You Can Also Read: BISP 8171 August 2025 Double Installment Announced for Flood-Affected Families And Previously Missed

Required Documents for Application

Before you begin registration, make sure to gather scanned copies or clear photos of the following:

- CNIC (Front and Back)

- Passport Size Photo / Selfie

- NTN certificate

- Proof of Residence (Utility bill or Rent Agreement)

- Proof of Business Location (Registry or Transfer Letter)

- Bank Account Details

- 2 References (Names, CNIC copies, Mobile Numbers – not family)

- Tax Return or Income Proof

- Financial Feasibility Document (if available)

You Can Also Read: CM Punjab Green E-taxi Program 2025 Has Been Started For Unemployed Persons Know How To Apply

Step-by-Step Online Registration Guide

Follow these steps carefully to register successfully:

Step 1: Visit the Official Portal

Go to the Punjab Government’s Loan Scheme Portal at CM Loan Scheme 2025

Step 2: Sign Up

Click on “Register” and enter:

- CNIC exactly as per NADRA records

- Full Name

- Mobile Number linked to CNIC

- Email Address

- Create a secure password

Step 3: Fill the Application Form

Enter your:

- Personal details

- Residential address and permanent address

- Business details

- Loan amount required

- Tier selection (T1 or T2)

Step 4: Upload Documents

Upload clear scanned files or images of your:

- CNIC (front & back)

- Passport size photo

- NTN certificate

- Business documents

- Income proof or tax returns

- Utility bills, lease agreement, or registry

Step 5: Submit and Pay Application Fee

- Submit the form and you’ll get a PSID code

- Pay the processing fee via ePay Punjab App, JazzCash, or ATM

- Fee:

- T1: PKR 5,000

- T2: PKR 10,000

Step 6: Track Your Application

After submission, you’ll receive a Tracking ID via SMS. Use it to monitor your application progress on the portal.

You Can Also Read: PM Laptop Scheme 2025 Distribution Begins Know Step-By-Step Method To Check Status You Are Eligible Or Not

What Happens After Application?

After application submission, your application will go through

- Your application will be reviewed and verified by officials

- You may be called for an interview or training session

- For Tier 2 loans, you must present valid collateral documents

- If approved, you will sign a loan agreement and receive disbursement in your bank account

- You may be invited for briefings on financial management or business operations

You Can Also Read: BISP Payment Delayed After Receiving SMS From 8171 Know Step-By-Step Causes & Solutions Method 2025

Success Tips for Applicants

If you want to be successful a loan, then must focus on the following points

- Use your own CNIC-linked mobile number

- Ensure all names match CNIC records exactly

- Don’t skip uploading key documents

- Do not apply multiple times with the same CNIC

- Upload a detailed business feasibility plan if you’re a startup

- Ensure you have a valid NTN and tax returns

- Prepare for a possible phone or in-person interview

- Use professional references (not relatives) for credibility

- If applying for Tier 2, make sure your collateral documents are ready

You Can Also Read: Maryam Nawaz Rashan Card 2025 Eligibility For 3000 Every Month Know How To Receive Card

Why You Shouldn’t Miss This Chance

This scheme stands out because it is:

- Interest-Free

- Government-backed

- Open to all Punjab residents

- Transparent, digital and easy to apply

- Focused on women, youth, and new entrepreneurs

If you are dreaming of launching or expanding your business in Punjab, this could be the best chance to turn that vision into a reality, without interest, with minimal upfront cost, and full government support.

You Can Also Read: BISP Payment Increase 2026 Approved For Old And New Registered Beneficiaries Know Full Guide

Final Words

The CM Punjab Loan Scheme 2025 has been reopened to give another chance to eligible individuals who could not apply earlier due to technical issues or missing documents. This interest-free loan program aims to empower youth, women, and persons with disabilities by offering financial support from 1 million to 30 million rupees. The scheme is designed to boost entrepreneurship and help people either start a new business or expand an existing one. Applications can be submitted online, making the process simple and accessible for residents across Punjab.

To apply, candidates must be Punjab residents, tax filers, and have a registered business or a solid startup plan. They are required to upload necessary documents such as CNIC, NTN, income proof, and business address before submitting the application. Once the form is submitted and the application fee is paid, the applicant receives a tracking ID to check their status. This initiative promotes digital inclusion and economic development by making interest-free loans available to deserving individuals without any burden of profit or markup.

You Can Also Read: Punjab Ration Card Distribution Has Been Started Check You Are Eligible Or Not Know Full Guide 2025

FAQs

Who can apply for the CM Punjab Loan Scheme 2025?

Punjab residents aged 25 to 55 who are tax filers and have a registered business or startup plan can apply. Special preference is given to women, youth, and differently-abled individuals.

What is the loan amount offered under this scheme?

The scheme offers interest-free loans from 1 million to 30 million rupees under two tiers. Tier 1 requires a personal guarantee, while Tier 2 needs secured collateral.

What documents are required for online application?

Applicants need CNIC, NTN, income proof, business documents, and references. All documents must be scanned and uploaded clearly.

How can one apply for the loan online?

Visit the official portal, create an account, fill the form, upload documents, and pay the application fee. A tracking ID is provided after submission.

What are some businesses eligible for this loan?

Businesses like grocery shops, IT startups, delivery services, and energy projects are eligible. The scheme supports both new and existing businesses.