CM Punjab Loan Schemes 2025

CM Punjab Loan Schemes 2025: The Punjab government, led by Chief Minister Maryam Nawaz Sharif, has launched a free loan scheme for the poor and deserving families of Pakistan so that those who are unemployed can start their own business with this loan and improve their future and improve their quality of life. In addition, loans of 30 million to 80 million are being provided to medium-sized traders so that they can expand their businesses, which will improve the economy of not only Punjab but also Pakistan and eliminate unemployment.

If you or anyone in your family is unemployed, then register in this program as soon as possible so that they can get a loan of up to 30 million from the Punjab government. If you are interested in this article and want to know all its information, then read the entire article given on this page carefully so that you can get the complete details of the loan scheme easily from home and you can get this information and register easily and after registering, you can get a loan of up to 30 million from the Punjab government.

You Can Also Read: How To Check Benazir Taleemi Wazaif Online Know Step By Step Process

Objective Of CM Punjab Loan Schemes 2025

There are many goals for the CM Punjab Loan Scheme for a 30 million loan.

- Help the poor families to start a business

- This scheme gives loan without interest

- To expand the business of medium-sized traders

- Poverty must be eradicated in Punjab

- Ending poverty in Punjab

- Repayment in easy monthly installments, without any interest

- Secure and transparent procedure through Bank of Punjab

- Opportunity for entrepreneurial autonomy for youth, women, and low-income individuals

- Tracking and support through online portal under the scheme

The above are some objectives of the CM Punjab loan scheme 2025. This is a good opportunity for low-income families, especially women.

You Can Also Read: Punjab Government Offers Free E-Bikes Scheme For Students Apply Today

Loan Structure And Tiers

The CM Punjab Loan Schemes 2025 has a good loan structure and provides loans in tiers. The complete details of the loan method is given below

| Tier | Loan Amount | Security | Tenure | Interest | Processing Fee |

|---|---|---|---|---|---|

| T1 | 1M – 5M | Personal Guarantee | 5 Years | 0% | 5,000 |

| T2 | 6M – 30M | Secured | 5 Years | 0% | 10,000 |

The loan structure is very good, and the repayment method is also easy. The educated people who have no job must apply ion this scheme and get a loan to start their own business to build a good future.

You Can Also Read:

Eligibility Criteria For Registration In Loan Scheme

There are some important conditions for the CM Punjab Loan Schemes 2025. Only those who meet all the required conditions can apply in this scheme. The complete detail is given below

- The applicant must be a resident of Punjab

- Age must be between 25 and 55 years

- The applicant must be an FBR tax filer

- The applicant’s tax history must be zero (no previous dues or liabilities)

- The business location must be within Punjab

- The applicant must have a valid CNIC number

- The applicant must have an NTN number

- The applicant must have a business premises, either owned or rented

If you do not meet all these conditions, then your application will be rejected. If your biodata is incorrect, then you must correct it through the NADRA office.

You Can Also Read: CM Maryam Nawaz Launches New Relief Program Rashan Card 2025

Required Documents For Easily Registration Process

For the registration in the CM Punjab loan scheme, started in 2025 by Maryam Nawaz Sharif. Only those can complete registration in the CM Punjab loan scheme who have all the required documents.

- Valid Computerized National Identity Card

- National Tax Number certificate

- FBR Tax Filer proof

- Business plan or feasibility report

- Proof of business premises ownership documents or rental agreement

- Recent utility bill of business or residence

- Passport-size photographs

- Bank account details

- Mobile number registered on the applicant’s CNIC

You must have all these documents. If you do not have then get from the NADRA office.

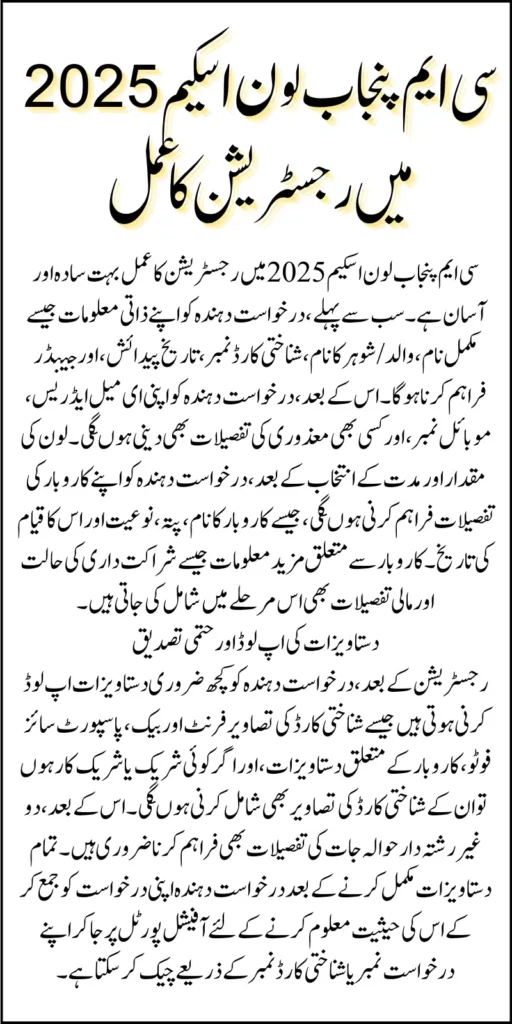

Simplified Registration Process – CM Punjab Loan Scheme 2025

You have to follow all the steps given for a successful application.

Personal & CNIC Information

- Enter your full name, Father’s/Husband’s name, CNIC number, issue/expiry dates, and date of birth

- Select gender, provide email address, and answer disability-related questions

- Mention your mother’s maiden name

Loan Selection & Amount

- Choose your loan tiers

- In tier 1 Loan amount is between 1 million to 5 million

- In tier 2 Loan amount is between 6 million to 30 million

- Select loan duration and enter the required amount

- Define loan purpose

Business Details

- Provide your business name, phone number, and full address as division, district, tehsil, city

- Mention date of establishment, nature & status of business, and your experience

- Declare if you own a vehicle and mention partnership share, if any

Financial & Employment Details

- Share your current employment status and business financial details

- Briefly describe your business activities and partner contributions

References & Documents Upload

Provide two references of non-relatives with their name, CNIC, mobile number, and relationship

- Upload the following documents:

- Passport-size photo/selfie

- CNIC front & back photo

- CNICs of partners/directors if anyone have

- Business documents

You Can Also Read: How To Apply In Apni Zameen Apna Ghar Scheme 2025 For 3 Marla Plot

How To Check Application Status After Registration

You can easily check application status after completing registration. For this, you have to follow given steps

| Step | Action |

|---|---|

| 1. Visit the Official Portal | Go to the official CM Punjab Loan Scheme 2025 website or portal provided by the Punjab government. |

| 2. Login | Use your registered email address and password to log in. If you don’t have a login, follow the instructions to create one. |

| 3. Locate Application Status | Once logged in, find the Application Status section. |

| 4. Enter Application Details | Enter your application number or CNIC number to fetch your application details. |

| 5. View Status | Click on the Submit button to view the latest update on your application. |

| 6. Contact Helpline (If Needed) | If you cannot access the status online, contact the helpline or customer support. |

If you follow all these steps, then you will easily be able to check your application status. If you face any problem, then you have to call at helpline.

You Can Also Read: CM Punjab wheat support program Online Registration Via WSP 2025 Punjab Gov PK

Final Words

The CM Punjab Loan Scheme 2025 provides a golden opportunity for unemployed and low-income individuals to secure loans without interest to start their businesses. With loan amounts ranging from 1 million to 30 million, the scheme aims to reduce poverty, create jobs, and foster economic growth in Punjab. The easy registration process and transparent loan structure, managed through the Bank of Punjab, make this scheme accessible to a wide range of applicants, including women, youth, and entrepreneurs. By providing the necessary financial support and resources, this initiative will help improve the quality of life for many families and contribute to the overall development of Punjab and Pakistan.

If you are eligible, it is important to gather all required documents and follow the streamlined registration process to apply for the loan. Be sure to check your application status regularly through the official portal to stay updated on your application’s progress. This scheme can help turn your entrepreneurial dreams into reality and create a better future for you and your family.

You Can Also Read: Maryam Nawaz Launches 5000 Scholarships For Talented Students –Apply Now

FAQs

Who is eligible to apply for the CM Punjab Loan Scheme 2025?

Applicants must be residents of Punjab, aged between 25 and 55, and an FBR tax filer with a valid CNIC and NTN number.

What loan amounts are available under the CM Punjab Loan Scheme?

The loan amounts range from 1 million to 30 million, divided into two tiers. Tier 1, which offers loans between 1 million and 5 million, and Tier 2, which provides loans between 6 million and 30 million.

Is there any interest on the loans provided through this scheme?

No, the loans are provided without any interest, ensuring financial relief for borrowers.

How can I check my application status after registration?

You can check your application status by logging into the official CM Punjab Loan Scheme portal and entering your application number or CNIC.

What documents are required for the CM Punjab Loan Scheme registration?

Required documents include a valid CNIC, National Tax Number certificate, FBR tax filer proof, business plan, and proof of business premises ownership or rental agreement.