KPK Ehsaas Naujawan Loan Program 2025

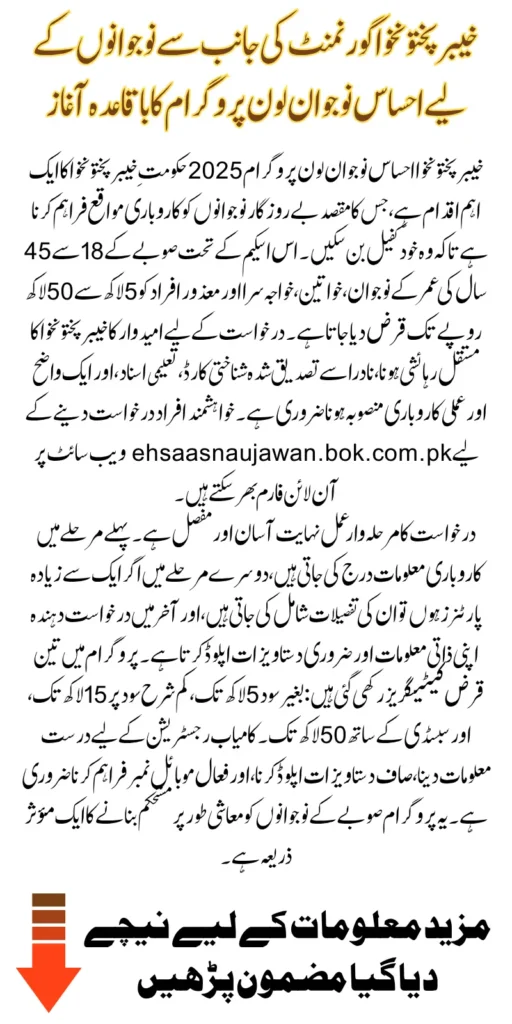

KPK Ehsaas Naujawan Loan Program 2025: The KPK Ehsaas Naujawan Loan Program 2025 is a new initiative launched by the Government of Khyber Pakhtunkhwa under the broader Ehsaas framework. It aims to empower the province’s youth by providing access to easy, interest-free or low-interest business loans. This program seeks to eliminate financial barriers for young people who want to start their businesses or expand existing ones. With unemployment rates high and economic opportunities limited in many areas, especially in rural and underdeveloped districts, this scheme serves as a lifeline for aspiring entrepreneurs.

In this article, we provide a clear, easy-to-understand overview of the program. We also walk you through the eligibility criteria, required documents, online registration steps, and key benefits of the loan. Whether you are a graduate, skilled worker, or someone with a business idea, this article will guide you through how to benefit from the KPK Ehsaas Naujawan Loan Scheme 2025.

You Can Also Read: 8171 Ehsaas Program Phase 3 August 13500 Announced For NSER Completed Beneficiaries Know Status Check

Main Purpose Of the KPK Ehsaas Naujawan Program

The core vision behind the KPK Ehsaas Naujawan Loan Program is to economically uplift the youth by offering them financial tools to break the cycle of poverty. It encourages self-employment, entrepreneurial growth, and innovation. The Khyber Pakhtunkhwa government has designed this scheme with inclusivity in mind, ensuring youth from both urban and rural regions have equal access to these opportunities.

By giving young men and women the means to create and sustain their businesses, the government aims to reduce reliance on government jobs and foster a culture of entrepreneurship.

You Can Also Read: Maryam Nawaz Launched Global IT Certifications Program For Punjab Youth In 2025 Know Full Details

Key Features of the Ehsaas Naujawan Loan Scheme

The EhsaasNaujawan Loan initiative brings a structured and transparent system of youth financial support. It stands out due to its accessibility, clarity, and inclusiveness. Here are the main highlights:

- Financial assistance up to Rs. 5 million based on business type and category

- Zero to low-interest loan categories based on loan amount

- Online application through a secure digital platform

- Equal participation opportunities for men and women

- Support for both startups and small-scale businesses

- Transparent processing system with follow-up tracking

These features are designed to minimize red tape and provide youth with a streamlined process for acquiring capital, eliminating unnecessary delays and intermediaries.

You Can Also Read: Punjab Parwaz Card 2025 Has Been Launched To Help People Find Jobs Abroad Know Application Process

Eligibility Criteria For Loan Application

The KPK government has defined clear eligibility criteria. Anyone meeting these criteria is encouraged to apply, especially if they have a solid business plan or idea. The eligibility criteria are given below

- Must be a Pakistani national and permanent resident of Khyber Pakhtunkhwa

- Age limit: Between 18 to 45 years, including women, transgender individuals, and differently-abled individuals

- Must possess a valid Computerized National Identity Card

- Should have a clear business idea or plan

- Both startups and existing businesses can apply

- Applicants should not be defaulters of any financial institution

These eligibility rules ensure that the program supports genuine applicants who have the capacity to use and repay the loan responsibly.

You Can Also Read: 8171 Ehsaas Program-BSP 2025 New 13,500 Collection Methods Via Mobile Van And ATM Machine

Required Documents For Easy and Successful Registration

You will need to prepare and upload some important documents during the registration process. The documentation ensures the legitimacy of your application and helps in quick verification:

- You must have a valid CNIC issued by NADRA, and your data should be clear and up to date

- Proof of KPK residency as the domicile certificate

- Educational certificates

- Business plan or proposal

- Bank account details

- Recent passport-size photograph

- Utility bill copy of the household

Make sure all documents are up-to-date, readable, and scanned clearly before uploading.

You Can Also Read: Benazir Hunarmand Program Online Registration Via Newly Launched Portal Know Stepwise Process

Step-by-Step Online Registration Process

The Government of KPK has created a centralized online portal where youth can apply directly for the loan. The process is designed to be mobile-friendly and accessible from all parts of the province. Applicants can register online through the official Bank of Khyber portal https://ehsaasnaujawan.bok.com.pk

Step 1: Business Information

- Enter your business name and the name of the managing director name.

- Provide the CNIC number of the managing director.

- Select the number of business partners (1 to 5).

- The system will open separate forms for each partner based on your selection.

Step 2: Partner Details (Partner 1 to Partner 5)

For each partner, including yourself, fill in:

- Full Name, CNIC (with issue and expiry date)

- Qualification, Technical Education (if any)

- Address (present and permanent), District & Tehsil

- Mobile number, SIM ownership status

- Father’s name, Date of Birth, Gender, Marital Status

- Number of Dependents, Disability status

- Upload CNIC (front and back) and Passport-size Photo

After saving Partner 1, the next partner section will auto-load until all selected partners are filled.

Step 3: Personal Information of Partners 2 to Partner 5 As Much You Have

After saving Partner 1 details, the system will automatically open the same form for Partner 2. If you selected more than one partner in Step 1, you must now enter complete personal information for each additional partner.

Repeat the same process for each partner:

- Fill in all required fields: name, CNIC, address, qualification, date of birth, SIM details, etc.

- Upload their CNIC (front and back) and passport-size photo.

- Once done, click “Save Partner 2” and continue with Partner 3, Partner 4, and Partner 5 if applicable.

The form will continue opening for the next partner until all selected partner entries are completed. If you selected only 2 partners, it will stop after Partner 2 and move to the final form. Make sure all information and uploads are complete and accurate for each partner. Incomplete entries will result in application rejection.

Step 4: Final Form Of Management Director Information & Documents

In the last section, submit and upload the following documents

- Educational Documents

- Domicile Certificate

- Business Proposal

- NADRA Verified CNIC

- Passport-Size Photo

Click “Submit Application” after uploading all required documents.

You Can Also Read: Punjab Students T-Cash Card 2025 Launched For Boys And Girls Know Step-By-Step Online Application Process

Types of Loans Offered

Depending on your proposal and need, the EhsaasNaujawan Loan Program 2025 provides three categories of loans:

- Tier 1: Up to Rs. 0.5 million — Interest-free (Qarz-e-Hasna model)

- Tier 2: From Rs. 0.5 million to Rs. 1.5 million — Low-interest (5% markup)

- Tier 3: From Rs. 1.5 million to Rs. 5 million — Subsidized interest (7% markup)

These tiers are meant to ensure that both small-scale entrepreneurs and mid-level business owners can get appropriate financing. Each tier has its own repayment plan and loan tenure, often ranging from 3 to 8 years.

Who Can Apply?

The following groups are especially encouraged to apply under this scheme:

- Youth with technical/vocational training

- Graduates with business ideas

- Small-scale entrepreneurs in rural and semi-urban areas

- Women entrepreneurs and home-based workers

- Differently-abled individuals with business goals

- Individuals affected by unemployment and poverty in KP

This inclusivity ensures wide outreach, even to marginalized groups who often find it difficult to access bank financing.

You Can Also Read: BISP 8171 Payment Status Alternatives Of 8171 Web Portal New And Easy Ways to Confirm 13500 Via ID Card

Loan Disbursement and Monitoring

Once an application is approved, the loan amount is directly transferred to the applicant’s bank account. The KP government has set up a digital tracking system to monitor disbursements and repayments. Each beneficiary is assigned a focal person from the loan cell who assists with questions and progress tracking.

In some cases, applicants may be called for in-person interviews or business feasibility evaluations. Transparency and accountability are key principles of the monitoring process.

You Can Also Read: Punjab Internship Program Phase 2 Launched – 60,000 Monthly Stipend For 2,000 Graduates Know Full Detail

Benefits of the Program

There are multiple direct and indirect benefits to the applicants and the province overall. These include:

- Financial independence for youth

- Increase in small-scale entrepreneurship

- Job creation in local areas

- Digital financial literacy improvement

- Boost in provincial economic activity

The long-term benefits are also critical. As more youth engage in entrepreneurship, the region will see a reduction in crime, a rise in household income, and improved community resilience.

Important Contact Points

For queries and technical issues, applicants can contact:

- Ehsaas Naujawan Helpline: 091-111-265-265

- KPITB Portal Support: support.kpitb.gov.pk

- Or visit the nearest Bok branches

These centers are equipped with staff who assist applicants, especially in regions with low internet penetration.

You Can Also Read: CM Punjab Loan Scheme AKF Registration Reopened For To Enroll The Left Beneficiaries Who Missed Previous

Tips to Improve Approval Chances

Before applying, it’s important to take certain measures that can significantly improve your chances of loan approval. The following tips will help you prepare a strong and complete application.

- Submit a realistic and practical business idea.

- Ensure all partner information is accurate.

- Upload clear documents (avoid shadows or blur).

- Use a working mobile number and valid CNIC.

- Write a brief business proposal that shows how the money will be used wisely.

These small but essential steps reflect your seriousness and can positively influence the reviewing committee’s decision on your loan application.

You Can Also Read: CM E-Taxi Scheme 2025 Online Registration Know Step-by-Step Full Guide To Apply

Common Issues Applicants Face

Many applications get delayed or rejected due to avoidable mistakes. Here are some common problems and how you can avoid them during the submission process.

- Incomplete Form: Make sure to fill all required fields.

- Invalid CNIC: Check your ID expiry date and ensure it matches NADRA.

- Poor Document Quality: Scan or use a good phone camera.

- Not Responding to Verification Calls: Stay active on your registered number.

By addressing these issues early, you’ll reduce the risk of rejection and ensure a smoother approval process for your application.

You Can Also Read: Complete Guide To Fix 8171 BISP Payment Issues 2025 And Receive Your Rs 13500 Without Delays

Final Words

The KPK Ehsaas Naujawan Loan Program 2025 is a golden opportunity for the youth of Khyber Pakhtunkhwa to bring their business ideas to life with strong financial backing. Whether you are planning to start a new venture or expand an existing setup, this program is built to offer accessible and interest-free loans in a transparent and easy-to-follow process.

With simple eligibility criteria, a fully online registration system, and clear partner and personal documentation steps, the program empowers young individuals to pursue self-employment. If you are a skilled individual, fresh graduate, or someone from a rural background with a clear vision, this initiative offers a practical path to economic stability and growth.

You Can Also Read: PSER Survey Registration Started Again To Qualify For Government Financial Program Know Details

FAQs

What is the age limit for applying?

Applicants must be between 18 and 45 years old.

Can women and differently-abled individuals apply?

Yes, the program is open to all, including women, transgender, and differently-abled youth.

Do I need a business idea to apply?

Yes, a basic business idea or plan is required for successful registration.

How much loan amount can I get?

You can get up to 5 million, depending on your business category.

Where can I apply online?

You can apply through the official portal: https://ehsaasnaujawan.bok.com.pk