PM Laptop Loan Scheme 2025

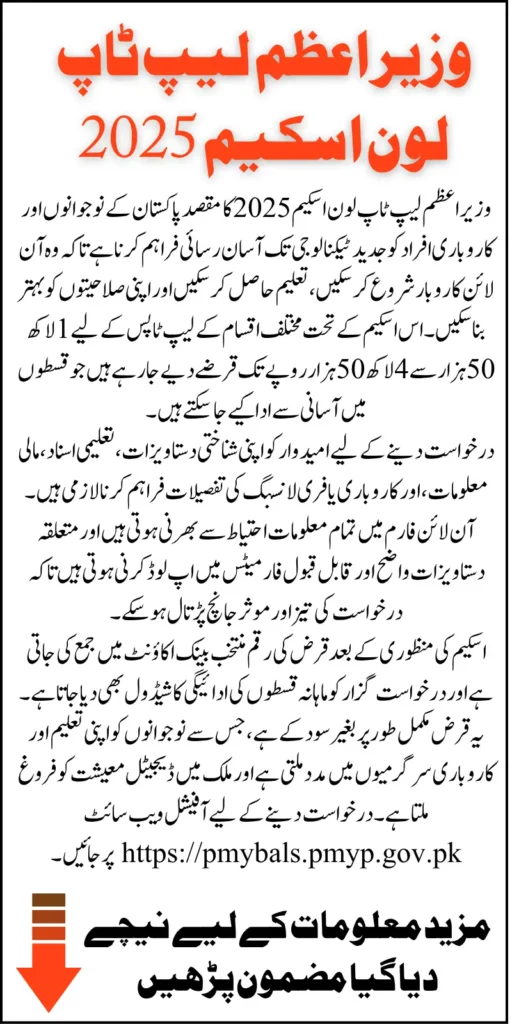

PM Laptop Loan Scheme 2025: The Government of Pakistan has launched the Prime Minister Laptop Loan Scheme 2025 to empower youth and aspiring entrepreneurs across the country. This scheme aims to provide laptops on easy monthly installments so that eligible individuals can start online businesses, work remotely, or pursue education and skill development. The laptop loan sizes range from PKR 150,000 to PKR 450,000 depending on the category selected.

This article provides a complete step-by-step guide on how to apply for the PM Laptop Loan Scheme 2025, including detailed instructions on filling out the application form, the documents required, and the loan processing procedure.

You Can Also Read: PM Youth Loan Scheme 2025 From 500000 To 7500000 On Monthly Installment Know Full Guide

Why the PM Laptop Loan Scheme 2025 Is Important For Youth

In today’s digital era, access to a good laptop is crucial for online business, freelancing, education, and digital work opportunities. However, many talented youth in Pakistan are unable to afford quality laptops due to financial constraints. The PM Laptop Loan Scheme 2025 bridges this gap by offering easy financing options with affordable monthly installments.

- Start online businesses or freelancing careers.

- Continue their education and gain digital skills.

- Enhance productivity and access global markets from home.

If you are a student, then you must apply for the laptop loan scheme.

You Can Also Read: Ehsaas Program 2025 Online Registration Process For Those Who Fully Meet the Requirements Know Full Guide

Required Documents and Information For Registration

Before starting your application, make sure you have the following documents and details ready:

- Visit the the PM Laptop Loan Scheme 2025

- CNIC Number and Issue Date

- Applicant’s recent photograph

- Scanned copies or pictures of CNIC’s front and back sides

- Date of birth as per CNIC

- University details including latest degree or transcript

- Proof of skills if you have any relevant skills

- Business details if you are applying as an entrepreneur or freelancer

- Information about any previous or ongoing loans from banks or microfinance institutions

- Contact details including primary and secondary mobile numbers

- Monthly income and household expenses information

Having these documents prepared in advance will make your application process smooth and error-free.

You Can Also Read: 8171 Web Portal Update August 2025 To Verify Payment Know the Government’s New Method To Check BISP

Step-by-Step Guide to Register for the PM Laptop Loan Scheme 2025

Access the official government website or designated online portal for the PM Laptop Loan Scheme 2025. Ensure you use the official link provided by the government to avoid fraud and scams.

Enter your basic personal details carefully.

- Your CNIC number in the format 36202-12345678-9

- CNIC issue date (format: mm/dd/yyyy).

- Choose the Laptop Category as basic, medium, or advance laptop according to your needs and eligibility.

- Select your Bank Name where you want the loan to be processed.

- Enter your full name as per your CNIC.

- Upload a recent applicant’s photograph.

- Upload scanned images of your CNIC’s front and back sides.

- Enter your date of birth as per CNIC.

- Select the number of dependents you have.

- Choose your gender.

- Enter your father’s, husband’s, or guardian’s name.

- Select your marital status.

- Choose your citizenship status and religion.

- Indicate if you have any disabilities.

Carefully review this information to avoid mistakes as it will be verified during loan processing.

Step 2: Provide Your Present and Permanent Address Details

Fill out your current residential details including:

- Present address

- Select present province, division, district, and tehsil from the dropdown menus.

If your permanent address differs from the present one, uncheck the “Same as Present Address” box and enter your permanent residential details similarly.

Step 3: Enter Contact Information and Financial Details

Input your:

- Primary mobile number

- Secondary mobile number

- Current monthly income or guardian’s income if you are a student or dependent.

- Monthly household expenses in PKR.

These financial details help determine your repayment capacity.

Step 4: University and Educational Details

If you are a student or recent graduate, provide:

- The name of your university from the selection list.

- Your latest or ongoing degree program.

- Current semester or academic standing.

- Upload your latest degree certificate or transcript as proof.

This helps validate your education status and eligibility.

Step 4: Skills and Business Information

Indicate if you have any professional or digital skills by selecting “Yes” or “No.” If yes, describe your skills briefly.

If you are applying as a freelancer or business owner, fill out:

- Business category (IT services, graphic design, digital marketing).

- Industry type.

- Your years of experience in the business.

- Mode of work (full-time, part-time, freelance).

- Provide your freelance platform profiles such as Fiverr, Upwork, LinkedIn, etc.

- Add your website portfolio or LinkedIn profile link for verification.

This information helps assess your business potential and loan purpose.

Step 5: Loan Details Selection

Select the desired loan size based on the laptop category

| Laptop Category | Maximum Loan Amount (PKR) |

|---|---|

| Basic Laptop | Up to 150,000 |

| Medium Laptop | Up to 300,000 |

| Advance Laptop | Up to 450,000 |

Make sure your loan request matches your financial capacity and intended laptop choice.

Step 6: Financing Details and Existing Loans Disclosure

You are required to disclose if you have taken any loans from

- Enter the Facility Type of any existing loans you have.

- Select the Bank Name from which the loan was availed.

- Provide the Approved Limit of the existing loan.

- Enter the Outstanding Amount remaining on the loan.

- Specify the Monthly Installment amount you pay for the loan.

- Declare that all the information provided in the form is correct and truthful, and click on the small box at start

- Confirm that you are not a serving employee of the federal government and click on the small box at start

After checking the complete registration form for laptop loan then click on the submit button.

You Can Also Read: Punjab Internship Program 2025 Deadline Announced For 60000 Monthly To 2000 Agriculture Graduates Know

Important Note About Uploading Documents

Before uploading your documents, it is important to ensure they meet the required standards to avoid any delays in processing your application. Properly uploaded documents can greatly speed up verification and improve your chances of approval. All uploaded documents must be

- Clear and legible

- Scanned or photographed in color

- In accepted file formats such as JPEG, PNG, or PDF

- Within the specified size limits on the application portal

Proper document uploads ensure faster verification and reduce the chances of rejection.

You Can Also Read: Punjab Apni Chhat Apna Ghar Scheme Phase 2 For 1500000 Loan Without Interest Know Registration

After Submission What to Expect Next?

After submitting your application, you have to follow the points below

- You will receive an acknowledgment message or email with a reference number.

- The loan processing team will verify your details and documents.

- You might be contacted for additional information or in-person verification.

- Once approved, the loan amount will be disbursed to your selected bank account.

- You will receive details about monthly installment payments and loan tenure.

Being aware of the next steps helps you prepare and respond accordingly to complete the loan process successfully.

You Can Also Read: CM Punjab 30 Million Loan Without Interest For Farmers To Buy Agricultural Machinery Know Full Details

Tips to Increase Your Chances of Approval

Preparing well before submission increases your chances of approval and helps avoid unnecessary complications. Paying attention to details can make a significant difference.

- Double-check all entered information before submission.

- Upload all required documents clearly and completely.

- Provide truthful financial and personal information.

- Avoid applying if you have existing unpaid loans.

- Maintain active mobile numbers for updates.

- Keep copies of your application and acknowledgment.

Following these tips ensures a smoother application experience and increases the likelihood of getting your loan approved.

You Can Also Read: Punjab Laptop Scheme Phase 2 Registration Has Started For Students Of Colleges And Universities Know Full

Conclusion

The PM Laptop Loan Scheme 2025 is an excellent opportunity for Pakistan’s youth to gain access to technology and digital resources essential for education and entrepreneurship. Following the above step-by-step registration guide carefully will maximize your chances of loan approval and enable you to benefit from this empowering government initiative.

Start your application today with all necessary documents ready, and take a significant step toward building your future in the digital economy.

You Can Also Read: BISP Sahulat Account Payment 2025 Launched

FAQs

Who is eligible for the PM Laptop Loan Scheme 2025?

Youth and aspiring entrepreneurs who meet income criteria and are Pakistani citizens can apply. Government employees are excluded.

Can I choose any laptop brand or specification?

You can select from predefined categories as basic, medium, and advance based on financing limits.

How long does loan approval take?

Approval time varies but generally takes a few weeks after document verification.

What if I cannot pay installments on time?

Contact your bank immediately to discuss rescheduling or restructuring options.

Is the loan interest-free?

Yes, the loan the in absolutely interest-free.